VALUES.

Metaverse Backup Protocol on Polygon Network

About Value

Value is the Metaverse Reserved Protocol on the Polygon Network depending on the $VALUES token. Each $VALUES token is backed by a resource chest (e.g. MAI, FRAX) in the Value store, providing a non-negligible fair value. The Value Protocol provides the possibility to support NFT tokens to storage liquidity. Value brings the monetary and hypothetical elements of the game to the market through tagging and holding. Value is part of a fork path for OlympusDAO with its own turn applied to NFT Bonding for the metaverse space and in light of the Polygon organization.

How does it work?

At a high level, Value consists of a protocol-managed treasury, protocol-held liquidity ( POL ), bond mechanisms, and wagering rewards designed to control supply expansion.

The sale of bonds generates profits for the protocol, and the treasury uses those profits to print $VALUES and distribute them to stakeholders. With liquidity bonds , the protocol can accumulate its own liquidity. See the entry below on the importance of POL .

Why do we need Value?

Dollar-pegged stablecoins have become an important part of cryptocurrencies due to their lack of volatility compared to tokens like Bitcoin and Ether. Users feel comfortable transacting using stablecoins knowing they have the same amount of purchasing power today vs. tomorrow. But this is a fallacy. The dollar is controlled by the US government and the Federal Reserve. This means the depreciation of the dollar also means the depreciation of this stablecoin.

Values aims to accomplish this by creating a free-floating reserve currency, $VALUES, which is backed by a basket of assets. By focusing on supply growth rather than price appreciation, Values hopes that $VALUES can serve as a currency capable of maintaining its purchasing power despite market volatility.

Is the coin VALUES stable?

No, $VALUES is not a stable coin. Instead, $VALUES aspires to be an algorithmic reserve currency backed by other decentralized assets. Similar to the idea of the gold standard, $VALUES provides a free-floating value that the user can always reuse, simply because the fractional treasury reserve of $VALUES takes on its intrinsic value.

VALUES supported, not pegged.

Each $VALUES is backed by 1 MAI, not pegged to it. Because the treasury supports every $VALUES when it trades below 1 MAI. This has the effect of pushing the price of $VALUES back to 1 MAI. $VALUES can always be traded above 1 MAI because there is no upper limit set by the protocol. Think pegged == 1, while supported >= 1.

You can say that the minimum price of $VALUES or intrinsic value is 1 MAI. We believe that the true price will always be 1 MAI + premium, but in the end it is up to the market to decide.

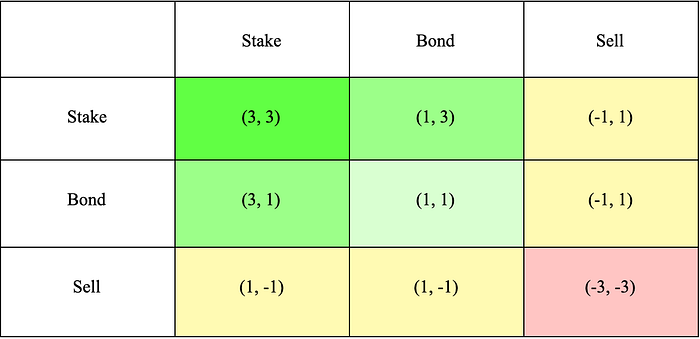

What's the deal with (3,3) and (1,1)?

(3.3) is the idea that, if everyone cooperates on Values, it will yield the greatest benefit to everyone (from a game theory point of view ). Currently, there are three actions the user can take:

Strike (+2)

Bond (+1)

Sell (-2)

Staking and bonding are considered beneficial protocols, while selling is considered a disadvantage. Staking and selling will also cause price movements, while bonding will not (we consider buying $VALUES from the market a prerequisite for staking, thus causing price movements). If both actions are profitable, the actor moving the price also gets half of the profit (+1). If the two actions contradict, the bad actor who moves the price gets half of the profit (+1), while the good actor who moves the price gets half of the loss (-1). If both actions are detrimental, meaning both actors sell, they both get half of the loss (-1).

So, considering the two actors, all the scenarios of what they can do and their effect on the protocol are shown here:

If we both stake (3, 3), it's the best thing for both of us and the protocol (3 + 3 = 6).

If one of us stakes and the other bonds, that's also great because staking takes $VALUES from the market and puts it into the protocol, while bonding provides liquidity and DAI for the treasury (3 + 1 = 4).

When one of us sells, it reduces the other person's effort to stake or tie (1 - 1 = 0).

When we both sell, it creates the worst outcome for both of us and the protocol (-3 - 3 = -6).

Why is PCV important?

Since the protocol controls the funds in its treasury, $VALUES can only be printed or burned by the protocol. This also guarantees that the protocol can always support 1 $VALUES with 1 DAI. You can easily determine the risk of your investment because you can rest assured that the protocol will forever buy $VALES under 1 DAI with treasury assets until there is nothing left to sell. You can't trust the FED but you can trust the code.

As the protocol accumulates more PCV, more runways are guaranteed for stakeholders. This means stakeholders can rest assured that current APY staking can be maintained for a longer period of time as more funds are available in the treasury.

What is Staking?

Staking is the main value accrual strategy of Values. Stakers stake their $VALUES on the Values website for rebase rewards. Rebase rewards come from the proceeds of bond sales, and may vary based on the amount of $VALUES wagered in the protocol and the rate of return set by monetary policy.

Further information:

Website: https://values.finance/

Twitter: https://twitter.com/ValuesDAO

Discord: https://discord.gg/xdNKGffeY2

Telegram: https://t.me/valuesDAO

by ; MoraCoin66 link: https://bitcointalk.org/index.php?action=profile;u=2579413

Komentar

Posting Komentar